44 current yield coupon rate

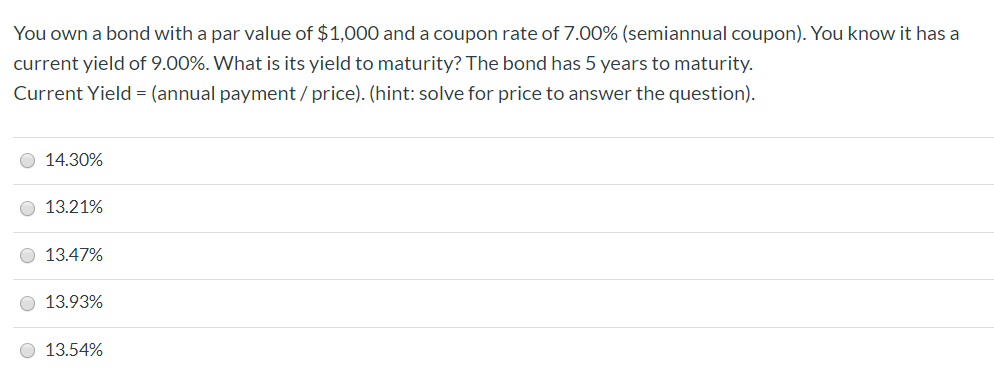

Current Yield Definition, Formula, and How to Calculate It - Investopedia How Current Yield Is Calculated If an investor buys a 6% coupon rate bond for a discount of $900, the investor earns annual interest income of ($1,000 X 6%), or $60. The current yield is... Euro area yield curves - European Central Bank WebCurrent year - euro area XML CSV; ... The ECB estimates zero-coupon yield curves for the euro area and derives forward and par yield curves. A zero coupon bond is a bond that pays no coupon and is sold at a discount from its face value. ... (instantaneous) interest rate for future periods implied in the yield curve. The par yield reflects ...

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

Current yield coupon rate

Coupon (finance) - Wikipedia WebIn finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and … Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the... Savings Account Rates Today: November 25, 2022 - Forbes Advisor The current average is 0.44% APY for a high-yield account with a $25,000 minimum deposit. That's the same as last week's APY. Savings Rates Today: Money Market Account (MMA)

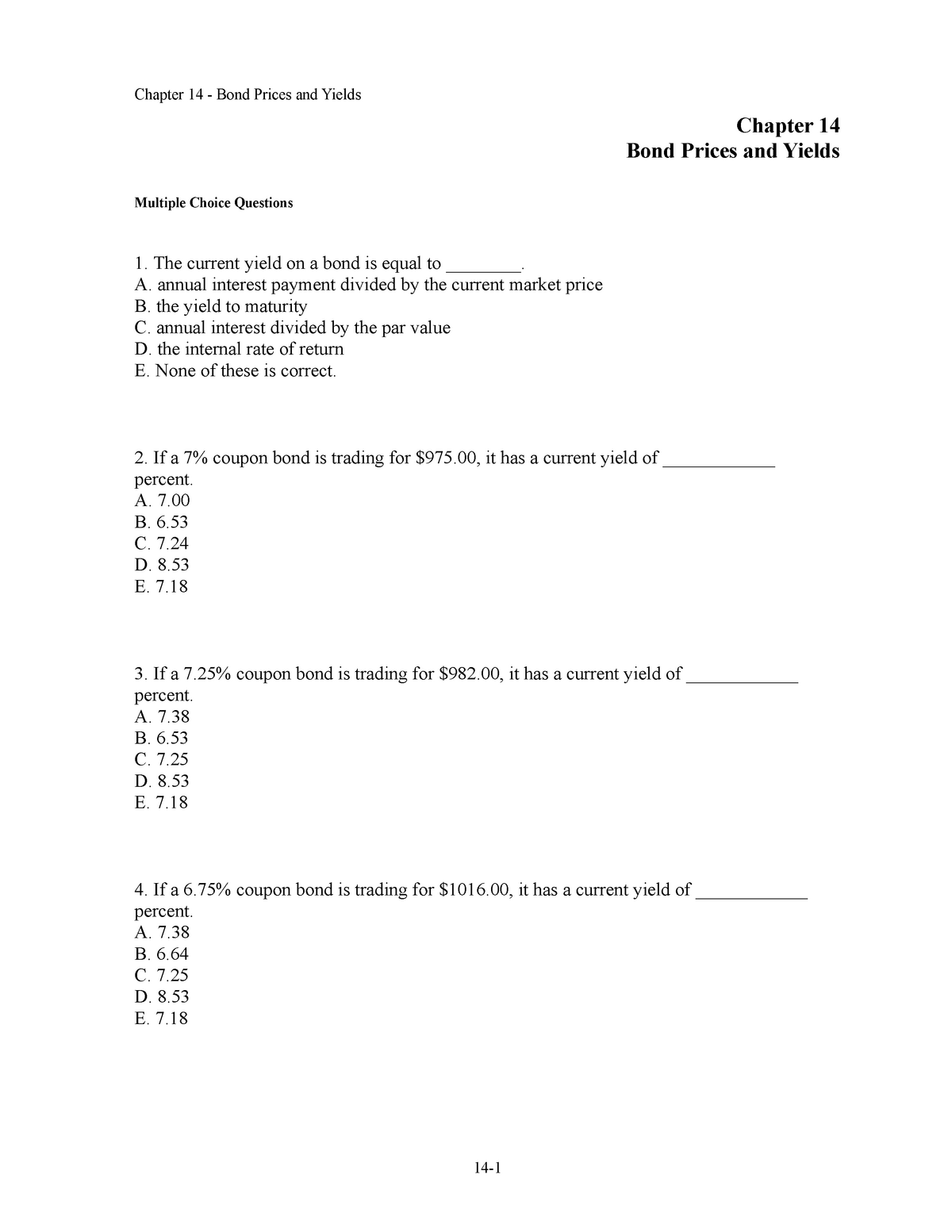

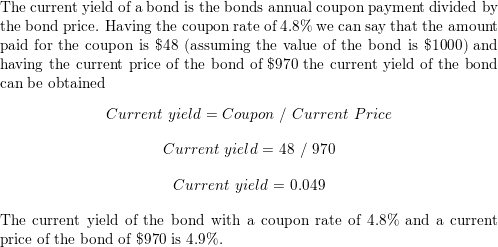

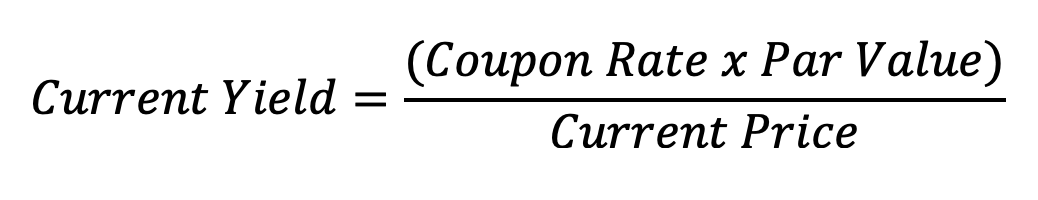

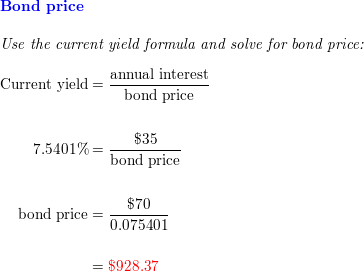

Current yield coupon rate. Current Yield Calculator | Calculate Current Yield of a Bond Current Yield = Coupon Payment / Market Price of Bond Current Yield Definition Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield in a matter of seconds is to just enter in the face value of the bond, the bond coupon rate percentage, and the market price of the bond. That's it! Coupon Rate Calculator | Bond Coupon The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. Current yield - Wikipedia WebExample. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows. = = $ % $ = $ $ = % Shortcomings of current yield. The current yield refers only to the yield of the bond at the current moment. Coupon vs Yield | Top 5 Differences (with Infographics) WebUnlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40.

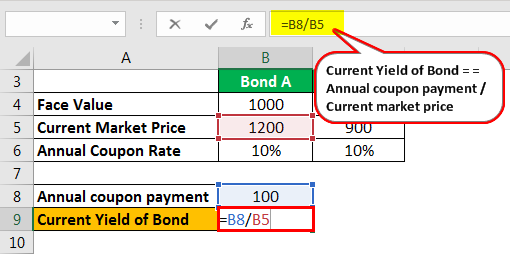

Creditaccess Grameen Limited - Bond Price, Yield Percentage, Coupon ... This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the bond. Current yield is simply the current return an investor would expect if he/she held that investment ... Current Yield of a Bond - Meaning, Formula, How to Calculate? The current yield of A & B Bond will be calculated as follows: For Bond A Step 1: Calculate Annual coupon payment Face value * Annual coupon rate 1000 * 10% = 100 Step 2: Calculate Current Yield = Annual coupon payment / Current market price = 100 / 1200 = 8.33% For Bond B Step 1: Calculate Annual coupon payment = Face value * Annual coupon rate Bond Yield Calculator – Compute the Current Yield - DQYDJ Current Yield (%): The simple yield of the bond computed from the trading price and the coupon payments. Yield to Maturity (%): The converged solution for yield to maturity of the bond (its IRR) ... So, a bond trading at $920 with a face value of $1000 and a 10% interest rate has a 10.87% current yield, higher than the one stated by the bond. ... Yield curve - Wikipedia WebThe slope of the yield curve is one of the most powerful predictors of future economic growth, inflation, and recessions. One measure of the yield curve slope (i.e. the difference between 10-year Treasury bond rate and the 3-month Treasury bond rate) is included in the Financial Stress Index published by the St. Louis Fed. A di An inverted yield curve is …

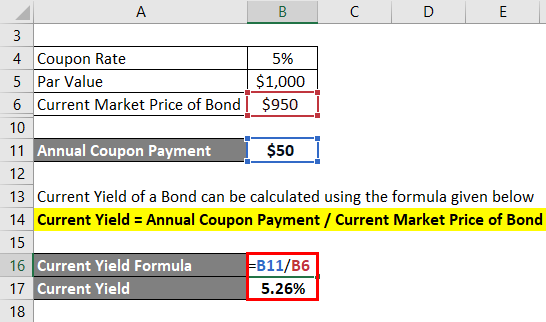

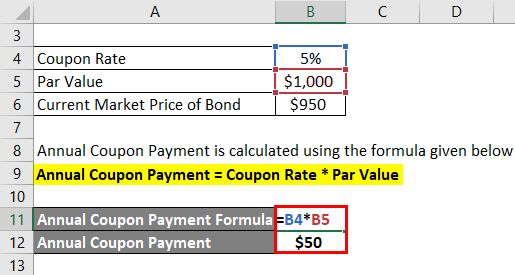

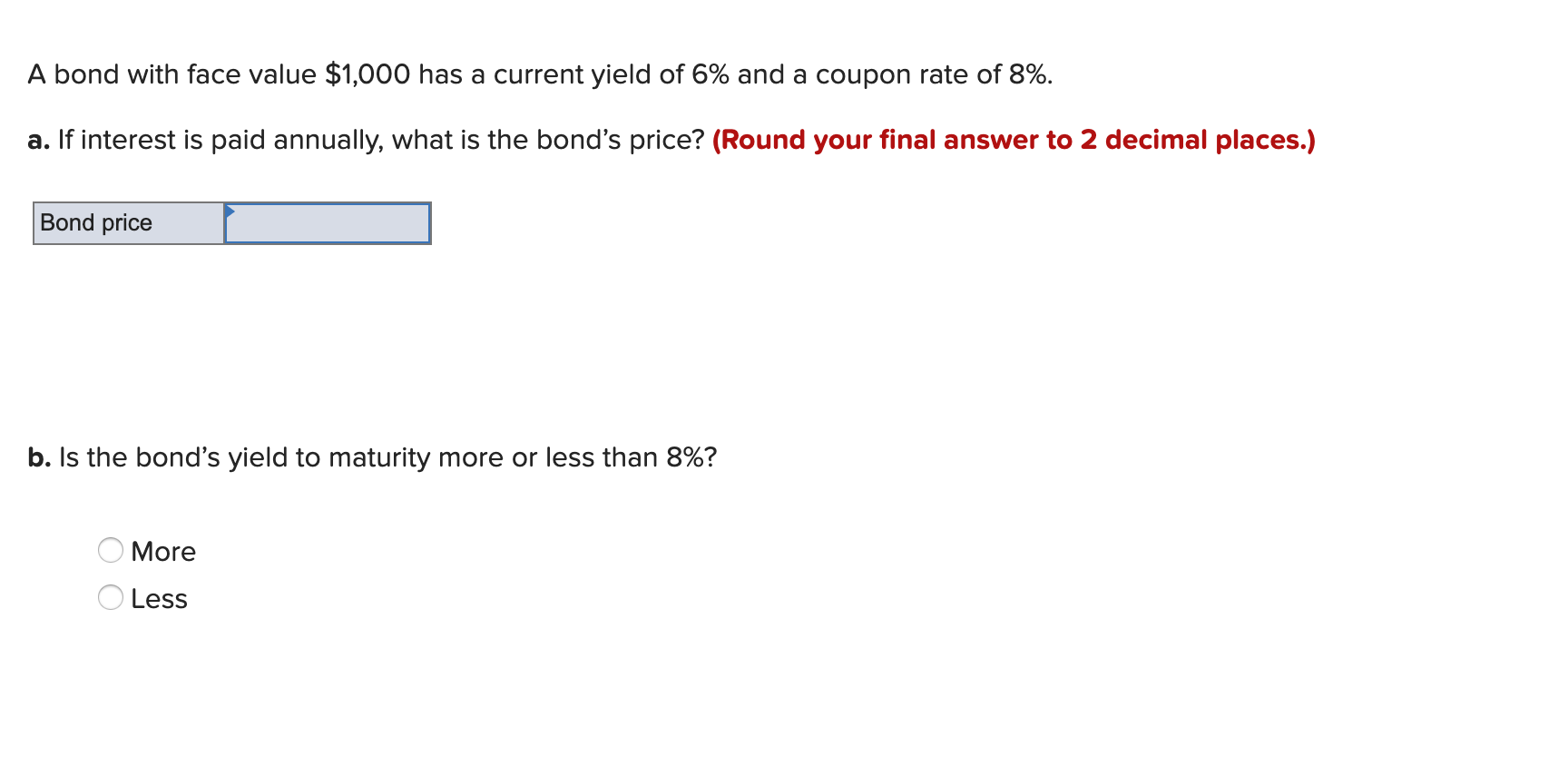

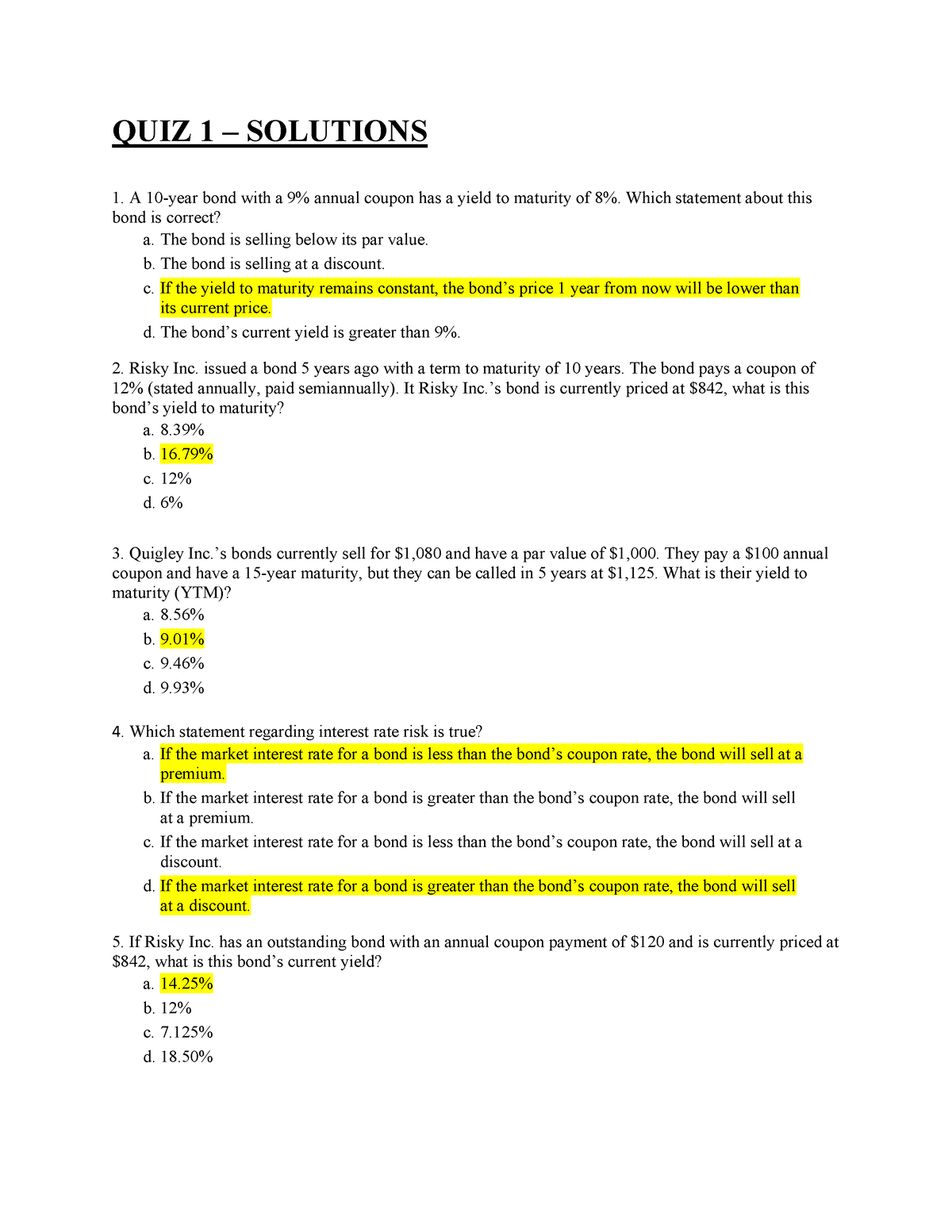

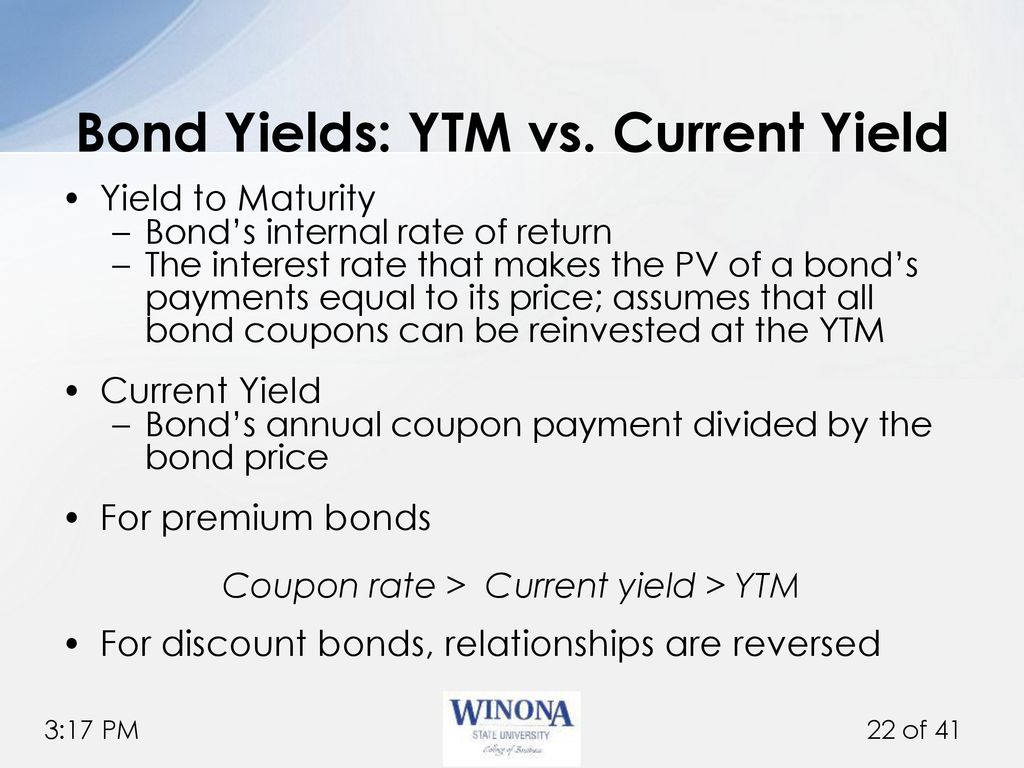

Current Yield Formula | Calculator (Examples with Excel Template) - EDUCBA Current Yield = Annual Coupon Payment / Current Market Price of Bond * 100% Relevance and Use of Current Yield of Bond Formula From the perspective of a bond investor, it is important to understand the concept of current yield because it helps in the assessment of the expected rate of return from a bond currently. Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Mortgage Rates: Compare Today's Rates | Bankrate Sep 20, 2022 · Today's national mortgage rate trends. On Tuesday, September 20, 2022, the current average rate for the benchmark 30-year fixed mortgage is 6.33%, rising 23 basis points compared to this time last ...

Current Yield | Formula, Example, Analysis, Calculator The current yield focuses more on its actual value now than on its value in the future. Current Yield Example Maria purchased a bond for $18,000. The bond has an annual coupon rate of 7%. This means her coupon amount would be $1260 per year. The market price of the bond is $14,500. What would the current yield be based on this market rate?

Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet To gain insight on how the coupon rate is holding up in the economic conditions of that point in time, investors can use more dynamic measures like yield and rate. Current yield is one way to contextualize the coupon value. Unlike a coupon which is static, the yield is a dynamic value that accounts for the current price of the bond.

What Is the Coupon Rate of a Bond? - The Balance WebNov 18, 2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond.

Current Yield - Meaning, Formula and Calculation Suppose a bond's face value is Rs 1,000 and has an annual coupon rate of 7%. The coupon payment would be Rs 70. If the bond's current price is Rs 950, then it would be calculated as follows. Current yield = 70/95 = 7.3% This means that you can expect a 7.3% return from the bond investment you want to invest in it at the current price.

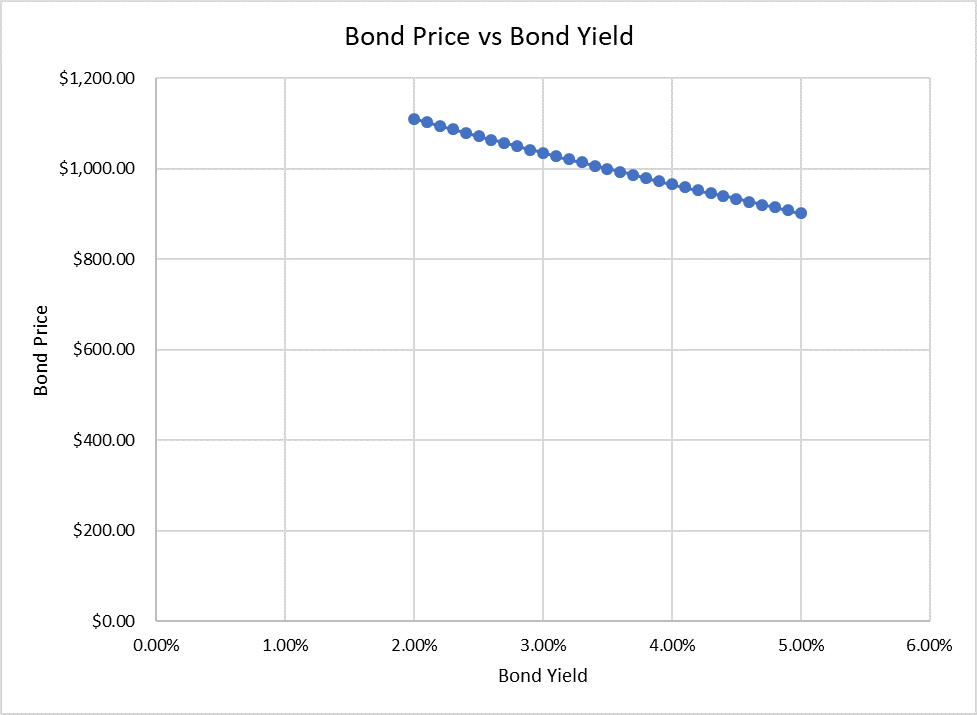

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Current Yield: Formula and Bond Calculation - Wall Street Prep The formula for calculating the current yield on a bond is as follows. Current Yield = Annual Coupon ÷ Bond Price For instance, if a corporate bond with a $1,000 face value ( FV) and an $80 annual coupon payment is trading at $970, then the implied yield is 8.25%. Current Yield = $80 Annual Coupon ÷ $970 Bond Price = 8.25%

Ntpc Limited - Bond Price, Yield Percentage, Coupon Rate | IndiaBonds This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the bond. Current yield is simply the current return an investor would expect if he/she held that investment ...

Resource Center | U.S. Department of the Treasury coupon equivalent 8 weeks bank discount coupon equivalent 13 weeks bank discount coupon equivalent 17 weeks bank discount coupon equivalent 26 weeks bank discount coupon equivalent 52 weeks bank discount coupon equivalent 1 mo 2 mo 3 mo 4 mo 20 yr 30 yr; 01/02/2002: n/a : n/a : n/a : 1.71 : 1.74 : n/a : n/a

Capitalization Rate Formula | Calculator (Excel template) - EDUCBA WebThe current market value of the property, as the name suggests, is the price in the current market that anyone would pay to buy the property. Net Operating Income = Rental Income + Other Income – Vacancy and Collection Loss – Property Management Costs. The capitalization rate shows the investor what would be his rate of return on the ...

Savings Account Rates Today: November 25, 2022 - Forbes Advisor The current average is 0.44% APY for a high-yield account with a $25,000 minimum deposit. That's the same as last week's APY. Savings Rates Today: Money Market Account (MMA)

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the...

Coupon (finance) - Wikipedia WebIn finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and …

Post a Comment for "44 current yield coupon rate"