42 us treasury coupon rate

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

› marketsStock Market Data – US Markets, World Markets, After Hours ... Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity.

Us treasury coupon rate

Treasury Coupon Bonds - Economy Watch The most important advantage of treasury coupon bonds is that they let you create a stable source of income during a given year. The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate. [br] Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued. Stock Market Data – US Markets, World Markets, After Hours … VerkkoStock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity.

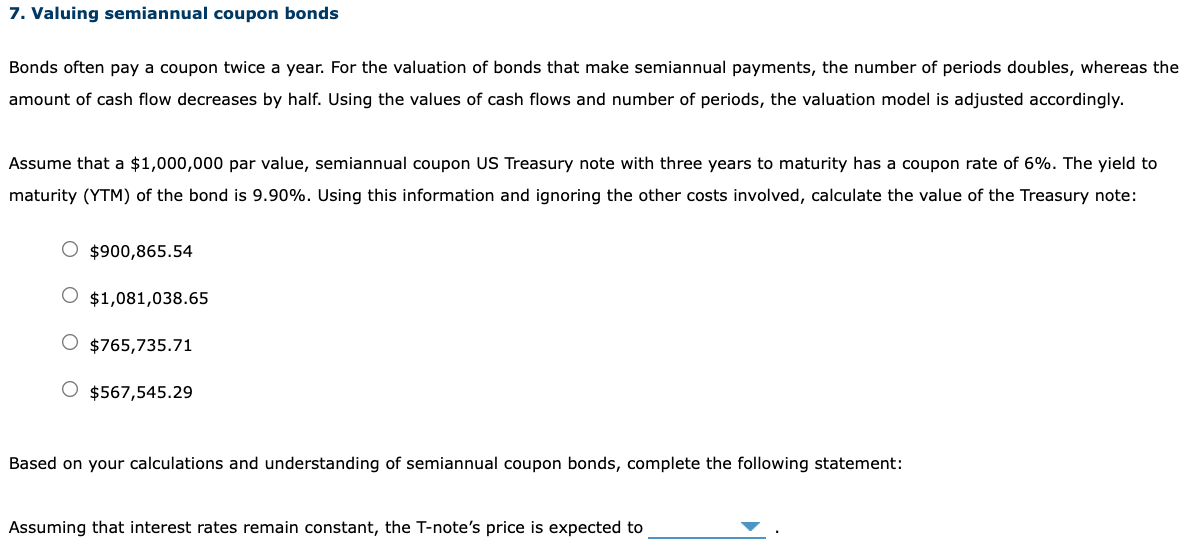

Us treasury coupon rate. Interest Rate Statistics | U.S. Department of the Treasury VerkkoNOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from … Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. How does the U.S. Treasury decide what coupon rate to offer on Treasury ... Actually the coupon is paid semi-annually (twice a year) not bi-annually (every other year). But as Jeff Lee pointed out, the 1.5% is the annual rate. It is paid in two 0.75% installments. So a $1,000 note paid $7.50 every six months, and $1,007.50 as the final payment (face amount plus last coupon) at maturity. What Are Treasury Bills (T-Bills) and How Do They Work? Verkko2.6.2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. What Is a Treasury Note? - Investment Firms What Do Treasury Notes Pay? Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields Treasury bonds, bills, and notes will all have varying yields. Longer-term Treasury securities typically yield higher returns than shorter-term Treasury securities. Us Treasury Coupon Rate - bizimkonak.com Treasury Coupon Issues U.S. Department of the Treasury. CODES (8 days ago) Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve … Visit URL. Category: coupon codes Show All Coupons Foreign Account Tax Compliance Act | U.S. Department of the Treasury VerkkoFATCA requires foreign financial institutions (FFIs) to report to the IRS information about financial accounts held by U.S. taxpayers, or by foreign entities in which U.S. taxpayers hold a substantial ownership interest. FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations (and FFI agreement, if applicable) or …

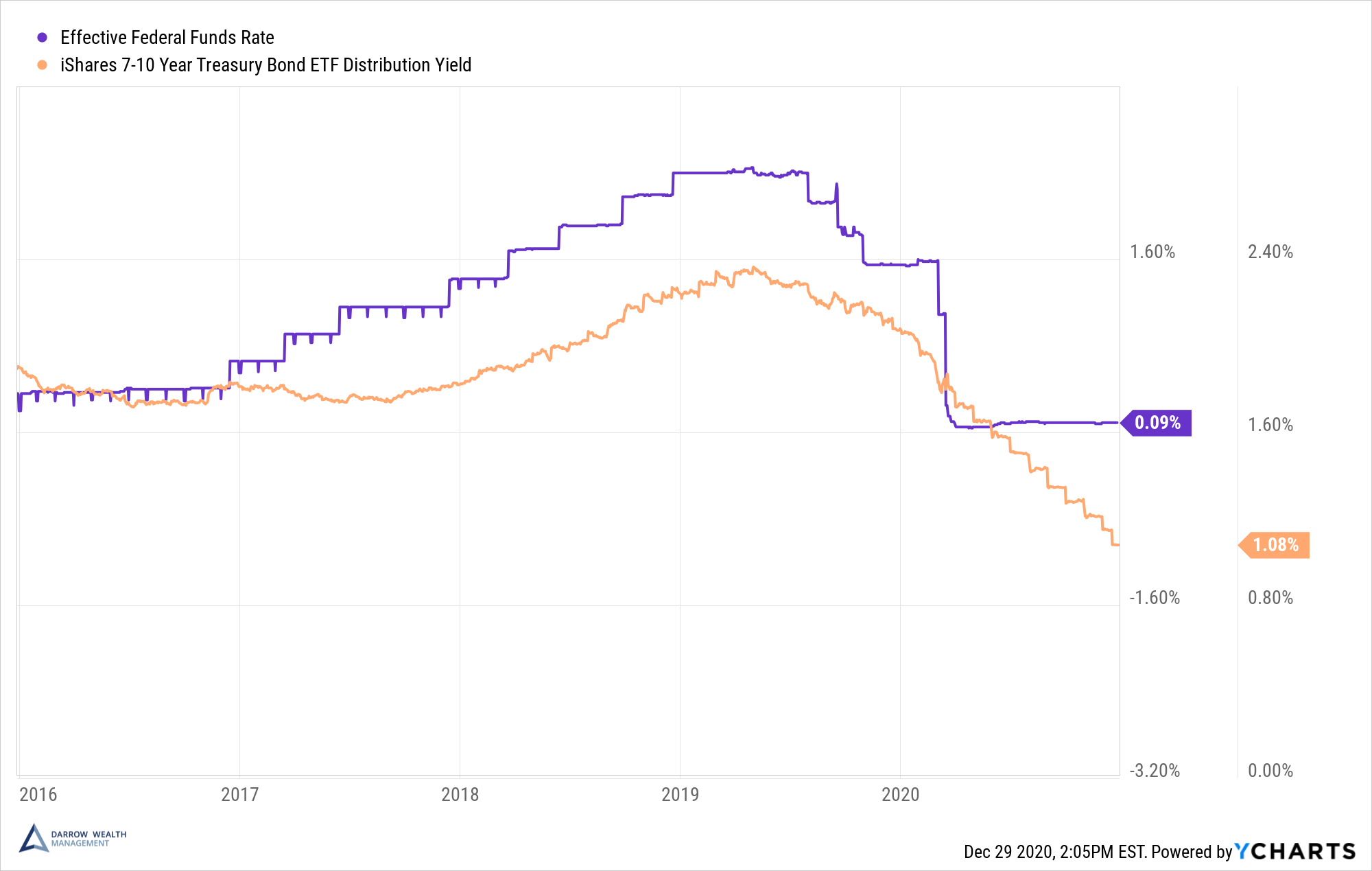

Coupon Rate Formula | Step by Step Calculation (with Examples) Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. 20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 4.28%, compared to 4.24% the previous market day and 1.99% last year. This is lower than the long term average of 4.36%. 10 Year Treasury Rate - YCharts Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 3.68%, compared to 3.71% the previous market day and 1.64% last year. This is lower than the long term average of 4.26%. Stats Related Indicators Treasury Yield Curve Quickflows US20Y: U.S. 20 Year Treasury - Stock Price, Quote and News - CNBC Get U.S. 20 Year Treasury (US20Y:Tradeweb) real-time stock quotes, news, price and financial information from CNBC.

10-Year Treasury Note and How It Works - The Balance It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ...

home.treasury.gov › policy-issues › tax-policyForeign Account Tax Compliance Act | U.S. Department of the ... Statement between the US Department of the Treasury and the Authorities of Japan to Implement FATCA (6-11-2013) Joint Communiqué on the Occasion of the Publication of the Model Agreement (France, Germany, Italy, Spain and the UK) (7-25-2012) Joint Statement from the US and Japan (6-21-2012)

What are coupons in treasury bills/bonds? - Quora Answer (1 of 12): They used to be actual additions to bonds printed on paper, representing the interest due at certain dates, so you could cut them from the bonds and present them for payment by the bond issuer. The nature of these financial instruments is that they generate interest payments at ...

Treasury's Certified Interest Rates — TreasuryDirect Treasury's Certified Interest Rates include Federal Credit Similar Maturity Rates, the Prompt Payment Rate, and Interest Rates for Various Statutory Purposes. Federal Credit Similar Maturity Rates Prompt Payment Rate Current Value of Funds Rate Interest Rates for Various Statutory Purposes

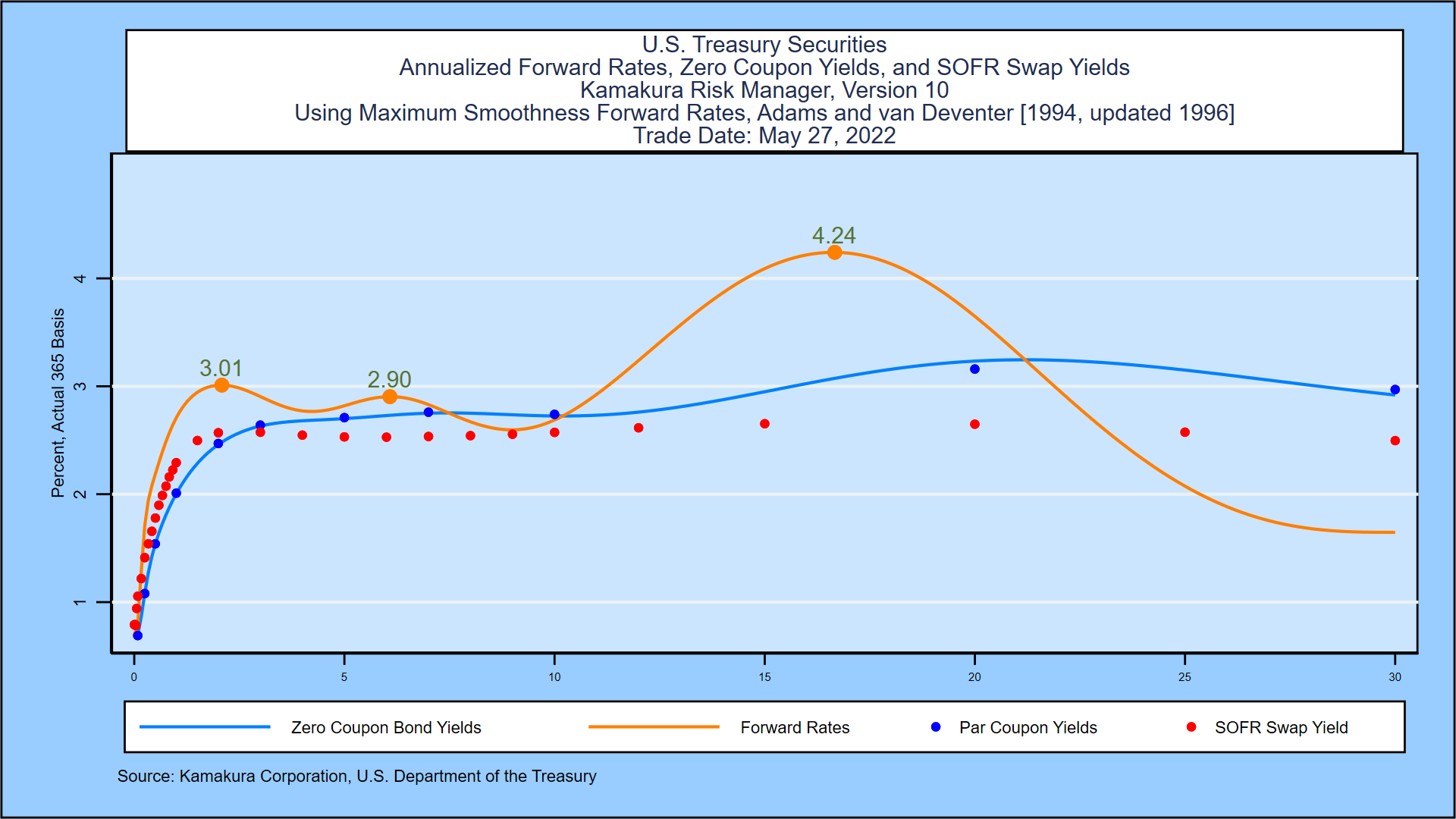

US Treasury Zero-Coupon Yield Curve - Nasdaq US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 3 days ago, on 18 Nov 2022 Frequency daily Description These yield curves...

home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

TMUBMUSD03Y | U.S. 3 Year Treasury Note Overview | MarketWatch Coupon Rate 4.500% Maturity Nov 15, 2025 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Aggressive Treasury selloff pushes 2- and 3-year yields above 4.3% in...

home.treasury.gov › policy-issues › financialOFAC Recent Actions | U.S. Department of the Treasury Statement by Secretary of the Treasury Janet L. Yellen on the Disbursement of $4.5 Billion in Direct Budget Support for Ukraine November 20, 2022 Statement by Secretary of the Treasury Janet L. Yellen on Election of the President of the Inter-American Development Bank

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of...

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Get U.S. 30 Year Treasury (US30Y:Tradeweb) real-time stock quotes, news, price and financial information from CNBC.

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds ...

Treasury Bill Rates - Nasdaq Treasury Bill Rates. From the data product: US Treasury (12 datasets) Refreshed 15 hours ago, on 19 Nov 2022 ... The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year. The Coupon Equivalent can be used to compare the yield on a ...

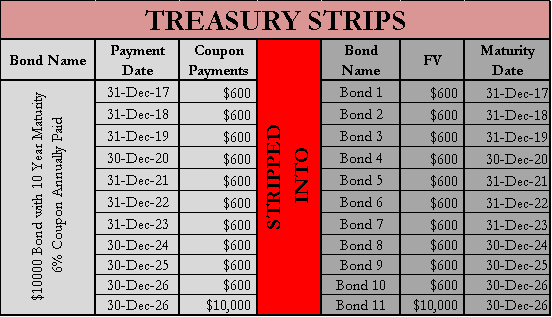

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ...

United States Rates & Bonds - Bloomberg VerkkoGet updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA.

Treasury Coupon Issues | U.S. Department of the Treasury VerkkoNominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly …

United States Rates & Bonds - Bloomberg.com Name Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year

Understanding Pricing and Interest Rates — TreasuryDirect Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes

TMUBMUSD30Y | U.S. 30 Year Treasury Bond Overview | MarketWatch TMUBMUSD30Y | A complete U.S. 30 Year Treasury Bond bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

iShares Treasury Floating Rate Bond ETF | TFLO - BlackRock Verkko18.11.2022 · 1. Exposure to U.S. floating rate Treasury bonds, whose interest payments adjust to reflect changes in interest rates 2. Easy access to a new type of Treasury bond (first issued in January 2014) 3. Use to put cash to work, seek stability, and manage interest rate risk

US Treasury Bonds - Fidelity VerkkoUS Treasury notes: $1,000: Coupon: 2-, 3-, 5-, 7-, and 10-year: Interest paid semi-annually, principal at maturity: US Treasury ... (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities ...

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Front page | U.S. Department of the Treasury VerkkoTreasury Coupon Issues. Corporate Bond Yield Curve. Federal ... Enhancing the US-UK Sanctions Partnership. View all Featured Stories. Press Releases. ... Treasury Long-Term Rates and Extrapolation Factors, and Treasury Real Long-Term Rate Averages. View This Data. Daily Treasury Par Yield Curve CMT Rates. 11/25/2022. 1 Month . …

OFAC Recent Actions | U.S. Department of the Treasury VerkkoExchange Rate Analysis. U.S.-China Comprehensive Strategic Economic Dialogue (CED) ... Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. ... Enhancing the US-UK Sanctions Partnership. View all Featured Stories. Press Releases. November 23, 2022.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways Coupon rates are the...

› us-treasury-bondsUS Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Stock Market Data – US Markets, World Markets, After Hours … VerkkoStock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity.

Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued.

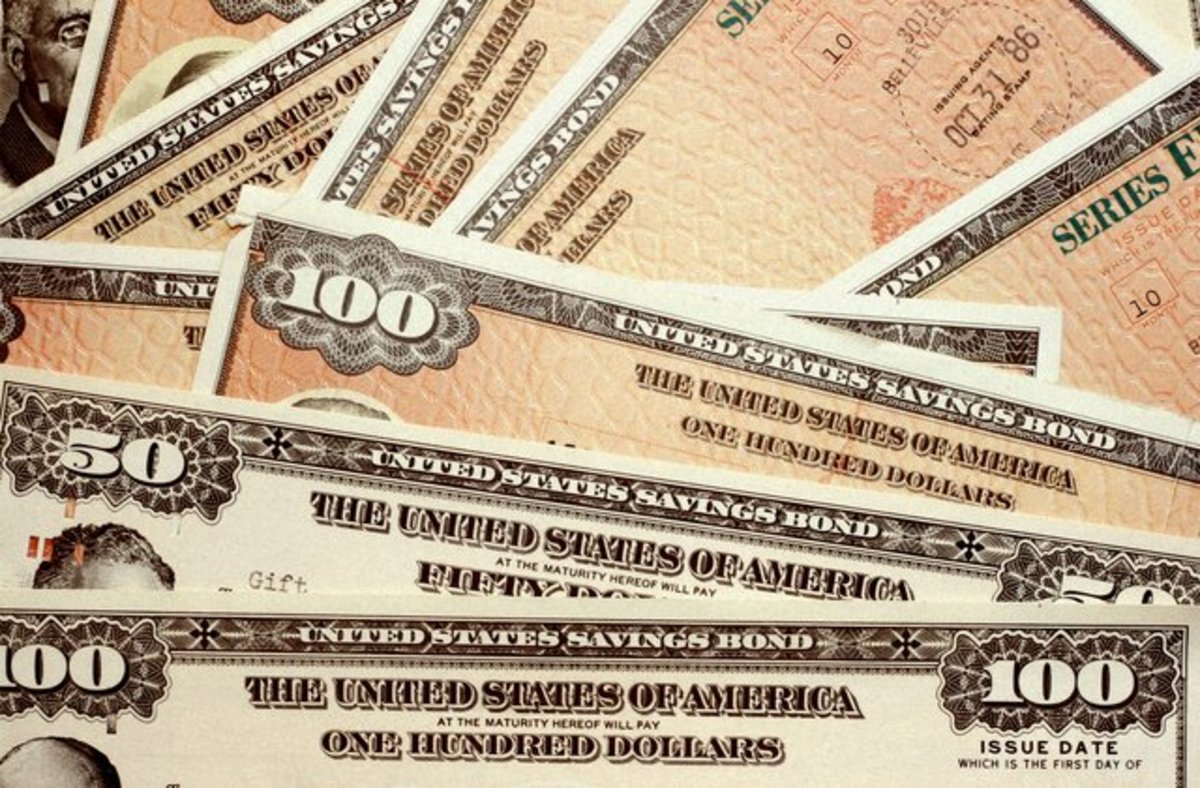

Treasury Coupon Bonds - Economy Watch The most important advantage of treasury coupon bonds is that they let you create a stable source of income during a given year. The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate. [br]

:max_bytes(150000):strip_icc()/GettyImages-172745598-5756f5bd3df78c9b46977f64.jpg)

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

:max_bytes(150000):strip_icc()/GettyImages-182832748-af3f3d3824034fdaa66ac937fc2d7a40.jpg)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 us treasury coupon rate"