41 zero coupon bond value

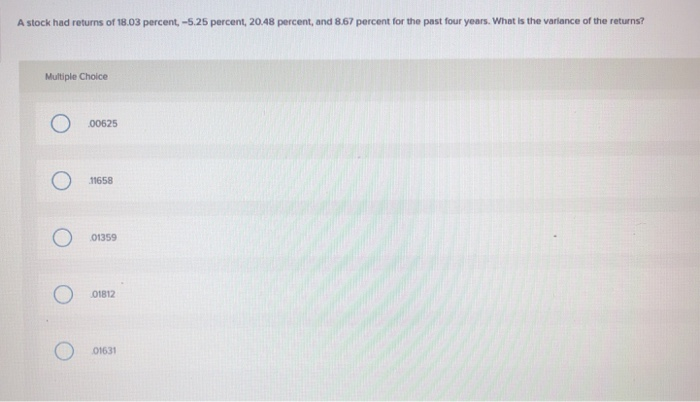

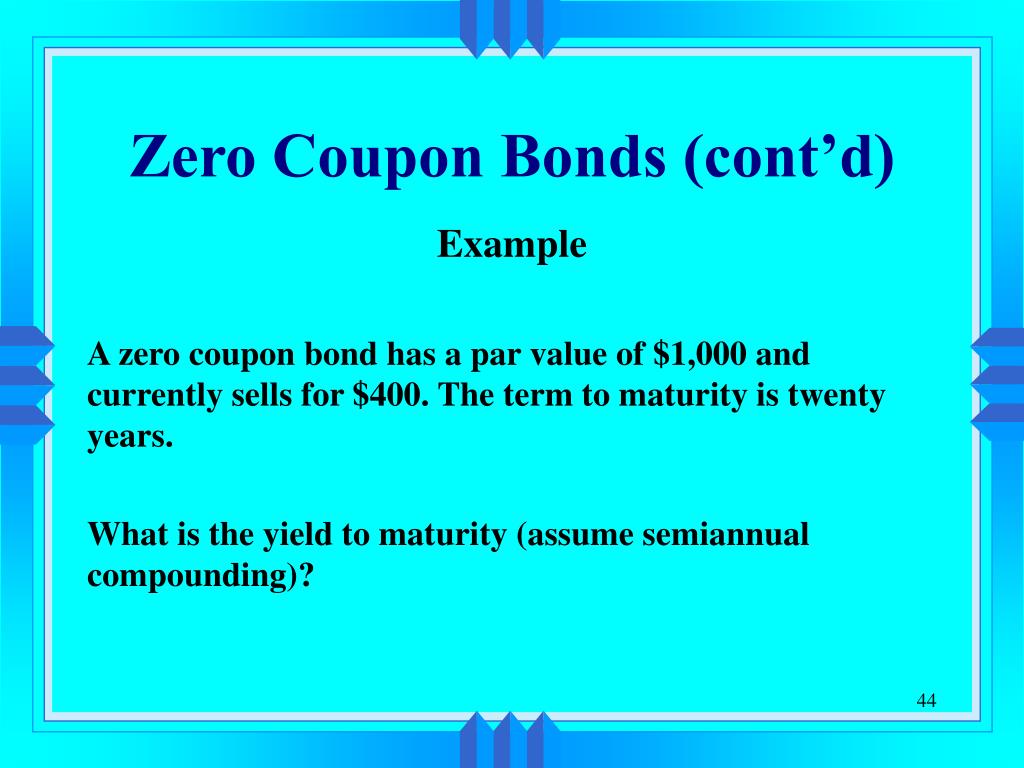

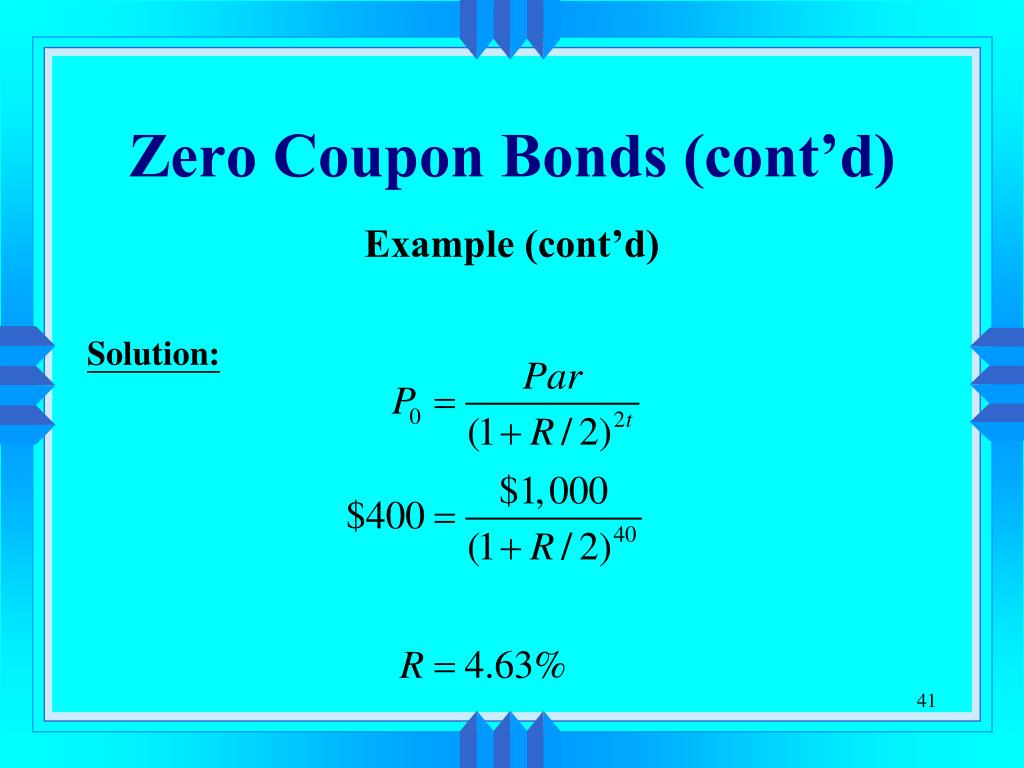

Zero Coupon Bond Calculator - MiniWebtool A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula PV and YTM of Zero-Coupon Bonds Calculator (on Google ... Example Problem:Consider the following $1,000-par-value zero-coupon bonds. What is the yield to maturity for each bond?Yield to Maturity of Zero-Coupon Bonds...

Zero Coupon Bond Definition and Example | Investing Answers Let's say you wanted to purchase a zero-coupon bond that has a $1,000 face value, with a maturity date three years from now. You've determined you want to earn 5% per year on the investment. Using the formula above you might be willing to pay: $1,000 / (1+0.025)^6 = $862.30

Zero coupon bond value

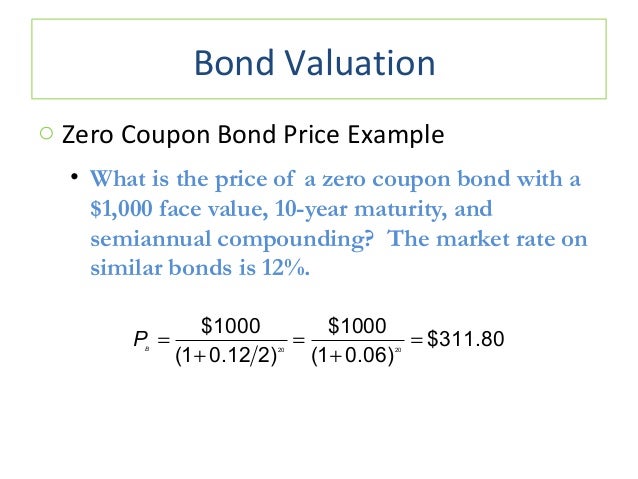

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... P = M / (1+r)n variable definitions: 1. P = price 2. M = maturity value 3. r = annual yield divided by 2 4. n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price o... Zero Coupon Bonds Explained (With Examples) - Fervent ... The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero coupon bond value. Zero Coupon Bond: Definition, Formula & Example - Study.com 12 Jan 2022 — The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 ... How do you calculate the price of a zero coupon bond? A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bonds - Financial Edge Training Calculating the value of a zero coupon bond. What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. Calculating yield-to-maturity or expected returns. What is the difference between a zero-coupon bond and a ... Long-term zero-coupon bond investors gain the difference between the price they pay for the bond and the amount they receive at the bond's maturity. This amount can be substantial because...

Zero Coupon Bond Value Calculator - Find Formula, Example ... A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ... Solved You find a zero coupon bond with a par value of ... You find a zero coupon bond with a par value of $10,000 and 13 years to maturity. If the yield to maturity on this bond is 4.7 percent, what is the price of the bond? Assume semiannual compounding periods. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Bond price Zero Coupon Bond Value Formula: How to Calculate Value of ... Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is $9,100. There are 2 years until maturity. katex is not defined YTM of this bond is 4.83%. What Is a Zero-Coupon Bond? | The Motley Fool May 04, 2022 · Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able to purchase a bond for $6,139.11, wait 10 years, and redeem it for $10,000....

Zero Coupon Bond (Definition, Formula, Examples, Calculations) These Bonds are initially sold at a price below the par value at a significant discount, and that’s why the name Pure Discount Bonds referred to above is also used for this Bonds. Since there are no intermediate cash flows associated with such Bonds, these types of bondsTypes Of BondsBonds refer to the debt instruments issued by governments or corp... Zero Coupon Bond Value Calculator Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. To illustrate, assume that on January 1, Year One, a company offers a $20,000 two-year zero-coupon bond to the public. Solved: A zero-coupon bond with face value $1,000 and ... A zero-coupon bond with face value $1,000 and maturity of five years sells for $746.22. What is its yield to maturity? What will happen to its yield to maturity if its price falls immediately to $730? Step-by-step solution 100% (54 ratings) for this solution Step 1 of 5

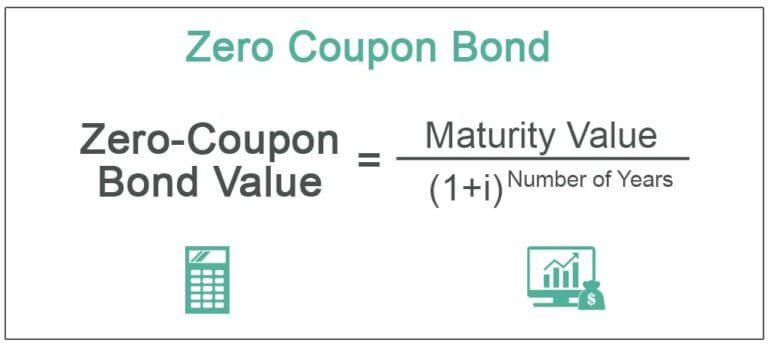

Zero-Coupon Bond - Assignment Point Since the issuer must give a return to the lender for buying the bond, a zero-coupon bond must sell at a discount. Zero-Coupon Bond Formula: Zero-Coupon Bond Value =Maturity Value/ (1+i) ^ Number of Years It's worth noting that the formula assumes the interest rate is multiplied once a year.

How is a zero-coupon bond taxed? - Terasolartisans.com Zero coupon bonds are subject to capital gains taxes and some zero coupon bonds require investors to pay taxes on the imputed interest that accrues on the bonds each year, even though that interest is not paid until maturity (as part of the bonds' face-value).

Zero-Coupon Bond Value | Formula, Example, Analysis ... The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Zero-Coupon Bond: Formula and Excel Calculator - Wall ... To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Zero Coupon Bond Formula : Accounts and Finance Formulas / Its yield results from the difference ...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

38 present value of a zero coupon bond Calculate the present value of a $1000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. 2. Consider a coupon bond that has a $1000 par value and a coupon rate of 10%. The bond is currently selling for $1150 and has eight years to maturity. Bond Present Value Calculator - buyupside.com Bond Present Value Calculator.

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero Coupon Bonds Explained (With Examples) - Fervent ... The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time.

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... P = M / (1+r)n variable definitions: 1. P = price 2. M = maturity value 3. r = annual yield divided by 2 4. n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price o...

Post a Comment for "41 zero coupon bond value"