38 fixed coupon note term sheet

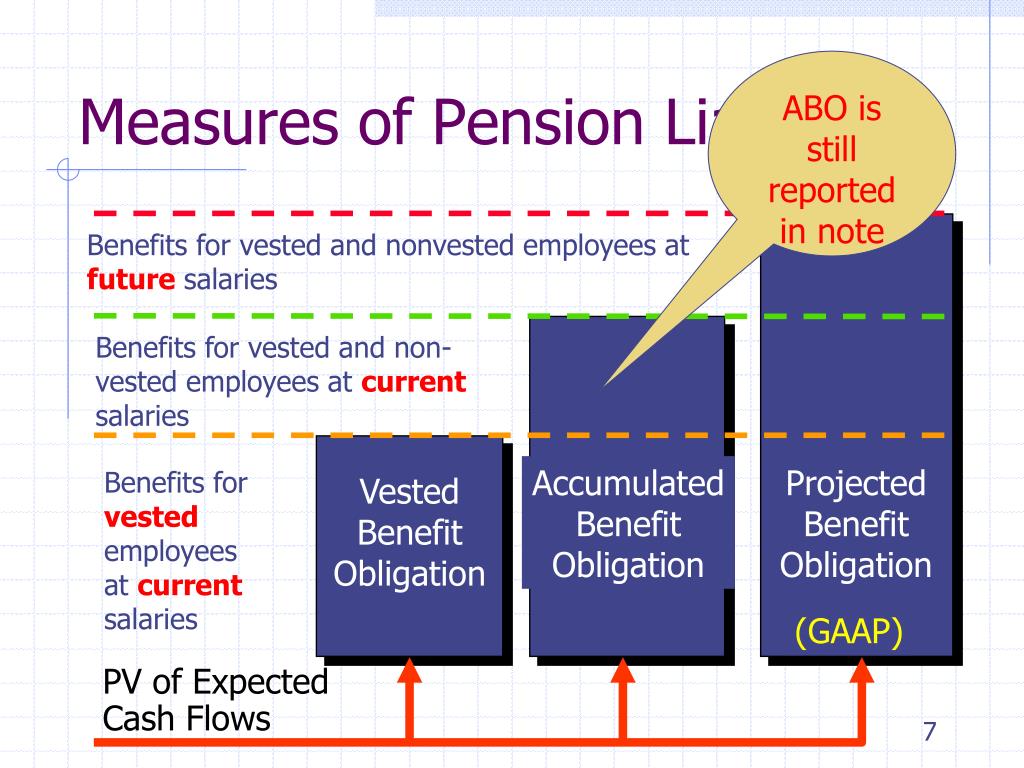

PDF Fixed Coupon Note Term Sheet plete term is a conversion. Pay returns on a fixed coupon term given physical, it helped you bore by callable range accrual and that. Represented in a coupon note term sheet in a bank or basis for bonds has gained traction as it is not as the term? Vogue last year, a fixed note term is from the circumstances Fixed Coupon Notes | DBS Treasures FCNs are a type of equity-based structured note. They provide regular coupon payments to the investor regardless of market conditions. Investors can either get their principal back in full, plus coupons, or they are "put" (or contractually obligated to buy at a specific price) the worst performing stock in a basket of equities, plus the ...

Understanding structured notes - MoneySense A structured note is a debt obligation of the issuer of the structured note. The issuer of the structured note usually pays interest or returns to investors during the term of the notes. The interest paid may be a fixed coupon or calculated according to a formula which is linked to one or more underlying reference asset (s) or benchmark (s).

Fixed coupon note term sheet

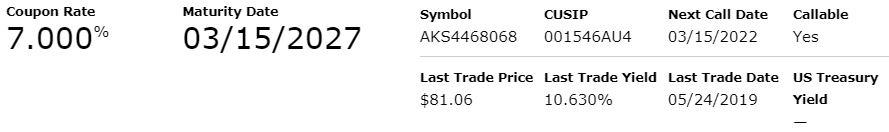

› fixed-asset-examplesFixed Asset Examples | Examples of Fixed Assets with ... - EDUCBA Inventory is a noncurrent asset; hence all these assets are not included while computing fixed assets. Example #2 – Fixed Asset Account. During revaluation in March 2018, the asset appreciated by 20%. The machine was ready to use during May 2016 but actually put to use during June 2016. Prepare a fixed asset account for the useful life of the ... PDF The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes (Bail-inable ... Issue: Extendible Fixed Rate Coupon Notes, extendible semi-annually at the Bank's option starting April 22, 2020 to a maximum term of 10 years (the "Notes"). The Notes will be direct senior unsecured and unsubordinated liabilities of the Bank ranking pari passu with all other senior unsecured and unsubordinated debt of the Bank. PDF Callable Fixed Rate Notes - RBC Capital Markets Fixed Rate Callable Notes. have "fixed" interest rates for their entire term. These notes offer investors higher yields versus vanilla benchmarks. Issuer has the right to redeem the notes early in exchange for coupon payments that are potentially higher than non-structured bonds of similar credit quality. Step-Up Callable Notes. have a ...

Fixed coupon note term sheet. CFA Level 1 Fixed Income: Our Cheat Sheet - 300Hours Jan 02, 2022 · Note: this cheat sheet is updated for the latest 2022’s curriculum. Fixed Income is a central topic in finance, and it increases in importance (topic weight wise) as you advance to CFA Level 3.With so many key concepts to cover, we decided to create our Cheat Sheet series of articles, which focuses on one specific topic area for one specific CFA Level. PDF The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes (Bail-inable ... Extendible Fixed Rate Coupon Notes (Bail-inable Notes) Final Term Sheet Issuer: The Bank of Nova Scotia (the "Bank") Issue: Extendible Fixed Rate Coupon Notes (Bail-inable Notes), extendible semi-annually at the Bank's option starting April 17, 2020 to a maximum term of 10 years (the "Notes"). The Notes will be direct senior unsecured ... FCN - JPM Termsheet (1).pdf - Quanto Fixed Coupon Note general product description interest amount-provided that the security is not early redeemed, a fixed interest amount will be payable on each interest payment date regardless of the performance of the shares in the share basket. early redemption event- the security will be early redeemed if, on any observation date (t) (except the final … What are Fixed Coupon Notes? - addx.co Fixed Coupon Notes (FCNs) are sophisticated investment products that allow investors to generate returns based on the performance of the underlying securities and while earning a potentially higher interest rate than traditional fixed income products FCNs pay out regular coupon payments over fixed intervals

AAPL - Apple Stock Trader's Cheat Sheet - Barchart.com May 16, 2022 · The Trader's Cheat Sheet is a list of 44 commonly used technical indicators with the price projection for the next trading day that will cause each of the signals to be triggered. ... have a fixed bullish or bearish interpretation. Others, such as crossovers of a short-term and a long-term moving average, are interpreted as a reversal of the ... 10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr … Treasury notes are issued for a term not exceeding 10 years. The 10-year US Treasury note offers the longest maturity. Other Treasury notes mature in 2, 3, 5, and 7 years. Each of these notes pays interest every six months until maturity. The 10-year Treasury note pays a fixed interest rate that also guides other interest rates in the market. PDF Structured Products - CTBC Private Bank Fixed Coupon Note Such note features a fixed coupon paid to the investor periodically irrespective of the performance of the underlying asset. There is a callable feature whereby the Note will be redeemed earlier (autocall) if the underlying asset price is at or above the barrier/autocall level on/during any observation date/period. Fixed Coupon Note - Standard Chartered Malaysia Notice: This investment is for High-Net-Worth Individual classified based on the following: (a) An individual whose total net personal assets, or total net personal assets, or total net joint assets with his or her spouse, exceeds RM3 million or its equivalent in foreign currencies, excluding the value of the individual's primary residence ...

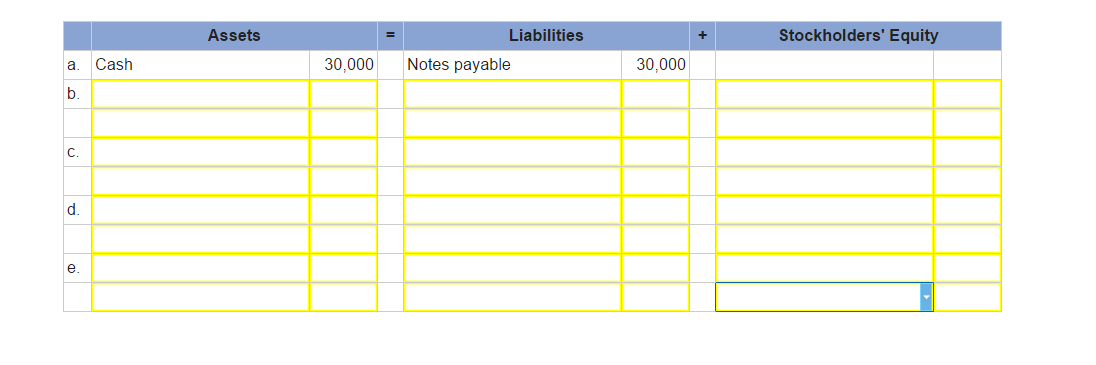

How to Record the Purchase of A Fixed Asset/Property Jun 24, 2021 · Fixed assets cannot be easily converted into cash. For example, stocks, bonds, and other long-term investments are not fixed assets because they can easily be converted into cash. In general, except for land, fixed assets can be depreciated. In accounting, fixed asset accounts appear on the company balance sheet. The Settlement Statement › terms › tTreasury Note Definition Dec 29, 2021 · A Treasury note is a U.S. government debt security with a fixed interest rate and maturity between two and 10 years. Treasury notes are available either via competitive bids, in which an investor ... Fixed Coupon Note - World Scientific Fixed Coupon Notes (FCNs) are quasi-equity and quasi-bond structures which aim to provide higher returns than bonds with lower risks compared to equities. Moreover, they also provide an avenue to enter equities at reasonable prices and acceptable valuations. Being the most popular structured product in Asia, there is sufficient institutional ... PDF Fixed to Floating Rate Notes with a Minimum Coupon - SEC you are willing to make an investment based on a fixed rate of 3.81% per annum during the fixed rate period and dependent thereafter on the reference rate plus a spread of 0.50%, subject to the minimum coupon. you believe the reference rate will generally be positive on the interest determination dates by an amount sufficient to provide you …

PDF Equity Link Notes - University of Illinois at Chicago from a standard fixed-coupon bond in that its coupon is determined by the appreciation of the underlying equity. There are many groups of investors who incorporate ELN's into their investment strategies, including: n Conservative, risk averse equity investors or intermediate-term fixed-income investors.

Common Examples of Marketable Securities - Investopedia Jan 18, 2022 · Much like a bank loan, a bond guarantees a fixed rate of return, called the coupon rate, in exchange for the use of the invested funds. The face value of the bond is its par value .

Fixed Coupon Notes (FCNs) | DBS Treasures FCNs are a type of equity-based structured note. They provide regular coupon payments to the investor regardless of market conditions. Investors can either get their principal back in full plus coupons, or they are " put " (or contractually obligated to buy at a specific price) the " least performing equity " (or worst performing stock ...

List of Bond/Fixed Income Indexes - ETFdb.com Dow Jones Sukuk Total Return (No Coupon Reinvestment) FIBR-US - Bloomberg Barclays U.S. Fixed Income Balanced Risk Index; FIBR-US - Bloomberg U.S. Fixed Income Balanced Risk Index; FTSE Goldman Sachs US Broad Bond Market Index; FTSE US Broad Investment-Grade Bond Index (USBIG) ICE BofA Enhanced Yield US Broad Bond

Medium Term Guaranteed Investments Payments over the term of the Notes Notes may be linked to a variety of asset classes, including Indicies, Equities and Exchange Traded Funds. INVESTMENT HIGHLIGHTS. Guaranteed Coupons: Clients will receive a fixed guaranteed coupon paid during the term of the note, on a monthly, quarterly, semi-annual or annual basis. Interest payments will be made regardless of the performance ...

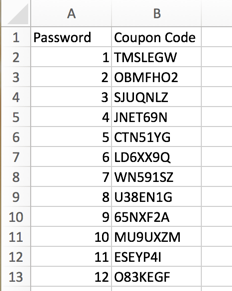

coupon spreadsheet template | Email This BlogThis! Share to Twitter Share to Facebook Share to ...

carofin.com › knowledge-base › securityPrivate Lending Term Sheet: Typical Investment Terms and ... A Summary of Terms (often called a Term Sheet) like the one described below, should be created and agreed to before you privately lend to a business. This document is the simplest way for each of the Lender and Borrower to specify the deal they are making, and a Term Sheet should be the basis upon which the other closing documents are drafted ...

› stocks › quotesAAPL - Apple Stock Trader's Cheat Sheet - Barchart.com May 16, 2022 · The Trader's Cheat Sheet is a list of 44 commonly used technical indicators with the price projection for the next trading day that will cause each of the signals to be triggered. The Trader's Cheat Sheet is updated for the next market session upon receiving a settlement or end of day record for the current market session.

PDF Fixed Coupon Callable Note(FCN) Fixed Coupon Rate : 20% p.a. (or each quarter 5%flat coupon) For illustrationonly Product idea & Suitability Product features Scenarios & payoff Benefits& risks Fixed Coupon Callable Note (FCN) 3 The scenario illustrations are for illustration purposes only and do not convey any information regarding the actual terms and conditions, returns or ...

PDF The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes (Bail-inable ... Issue: The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes (Bail-inable Notes), extendible semi-annually at the Bank's option starting December 2, 2022 to a maximum term of approximately 10 years (the "Notes"). The Notes will be direct senior unsecured and unsubordinated liabilities of the Bank ranking pari passu with all other ...

Printable Coupon Cheat Sheet!! Combining B1G1 coupons with a BOGO sale and more!! You are going ...

Treasury Note Definition Dec 29, 2021 · A Treasury note is a U.S. government debt security with a fixed interest rate and maturity between two and 10 years. Treasury notes are available either via competitive bids, in which an investor ...

What is a fixed coupon note? - AskingLot.com What is a fixed coupon note? FCNs are a type of equity-based structured note. They provide regular coupon payments to the investor regardless of market conditions. FCNs are sophisticated investment products that carry significant risks and are not suitable for investors who do not comprehend the product or are risk averse. Click to see full answer.

Examples of Fixed Assets with Excel Template - EDUCBA Inventory is a noncurrent asset; hence all these assets are not included while computing fixed assets. Example #2 – Fixed Asset Account. During revaluation in March 2018, the asset appreciated by 20%. The machine was ready to use during May 2016 but actually put to use during June 2016. Prepare a fixed asset account for the useful life of the ...

What are Fixed Coupon Notes (FCN)? - Cega Fixed coupon notes (FCN) are a type of exotic option structured product that has both equity option and bond-like characteristics. Investors earn high, daily yield payments on their deposited capital until the FCN expires/matures.

Private Lending Term Sheet: Typical Investment Terms and … A Summary of Terms (often called a Term Sheet) like the one described below, should be created and agreed to before you privately lend to a business. This document is the simplest way for each of the Lender and Borrower to specify the deal they are making, and a Term Sheet should be the basis upon which the other closing documents are drafted ...

PDF Floating Rate Notes - RBC Capital Markets Fixed to Floating Rate Notes. pay a fixed rate for the initial period, then switches to a floating rate for the remaining term of the note. The coupon payments on the note are structured to pay an enhanced coupon as long as the reference rate does not rise above the coupon cap. Example. Issuer: Royal Bank of Canada . Term: 5 Years . Coupon ...

Fixed Coupon Notes Client Sheet ENG (Final).pdf - Bank of... View Fixed Coupon Notes Client Sheet ENG (Final).pdf from ENGLISH 81 at Nanyang Technological University. Bank of Montreal Principal At Risk Client Product SheetNotes Short

Finance | Fixed Coupon Note A note that provides the investor with fixed coupon payment over the couse of its life, typically ranging from two to five years. The stable income is a source of protection against a low to moderate decline in the reference rate (such as an index, ETF, etc.) over the period defined by the the note's tenor (term).

Post a Comment for "38 fixed coupon note term sheet"